If you decide to buy real estate in Spain using a mortgage, then you have to choose at what rate to take out a loan.

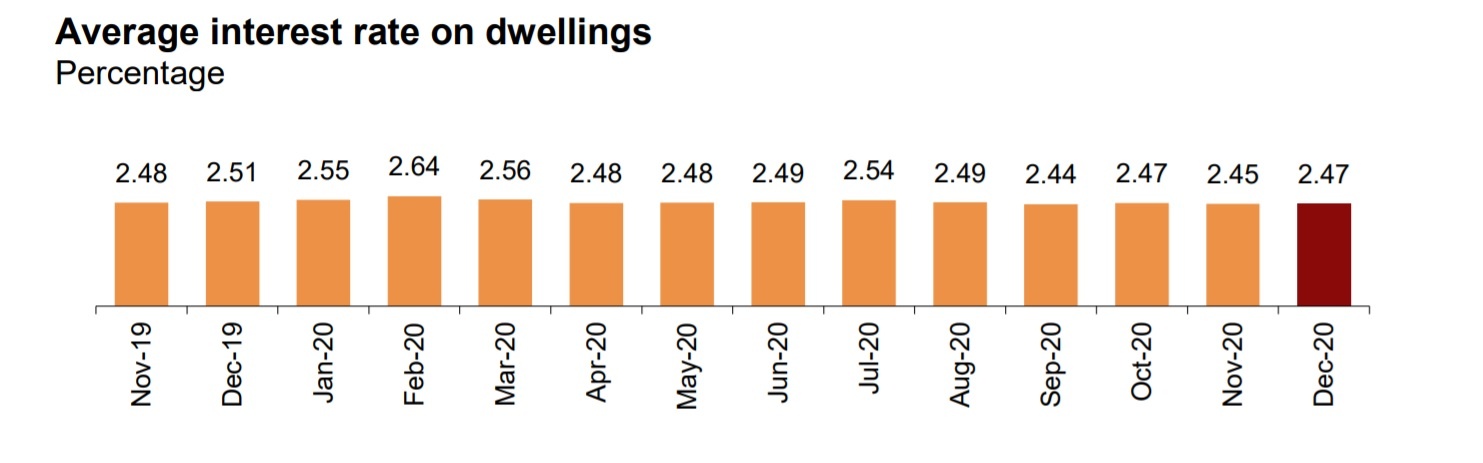

According to data from the Mortgage Statistics, published by the National Institute of Statistics (INE), the previous year showed the equal interest of borrowers to the fixed and variable rates.

Thus for mortgages constituted on the total of properties in December, the average starting interest rate was 2.53% and the average term was 24 years. A total of 51.6% of mortgages used a variable interest rate, and 48.4% used a fixed rate. The average starting interest rate was 2.20% for variable rate mortgages and 2.97% for fixed rate mortgages.

50.6% of mortgages constituted on dwellings used a variable interest rate and 49.4% used a fixed rate. The average starting interest rate is 2.21% for variable rate home mortgages and 2.79% for fixed rate mortgages.

These figures fully reflect the situation that I see in practice. As the profiles of the applicants are different, each client has different needs and wishes.

Types of mortgages in Spain

Let’s check what are the types of mortgage loans. There are three of them:

- Fixed (same rate and monthly repayment during the complete loan term)

- Variable (Euribor + differencial, revised annually)

- Mix of fixed and variable (start with a fixed rate and after agreed term this will change to variable)

Each type has its pros and cons.

For example, fixed type is stable. It gives you the security of knowing the monthly repayments during the term of the loan. Nevertheless, the repayment will be a bit higher, since the rate is higher. The cons: a slight higher rate than variable.

Pros of variable rate: lowest possible rate, so you can take the maximum advantage of the current interest rates. However, you should bear in mind, that once the Euribor will start to go up, and your interest rate and monthly repayment will go up as well.

In the third case, the situation manifests a combination of the above

What is better fixed or variable mortgage in Spain?

This depends on the wishes of the client and does not really affect the feasibility. In case the income is low, a variable rate improves your DTI, which can improve feasibility.

An important role is played by the age of the applicant. If the client is over 55, I recommend a fixed rate, since the rates are at an all time low and the expectation is this will be for some more time.

If you are younger, you can enjoy the lower rate for as long as possible and when the Euribor starts to rise again you can choose to change it to a fixed mortgage rate.