More restrictions and bank requirements. Meanwhile, a lot of opportunities for non- resident buyers. What do experts think about a mortgage in Spain in 2021?

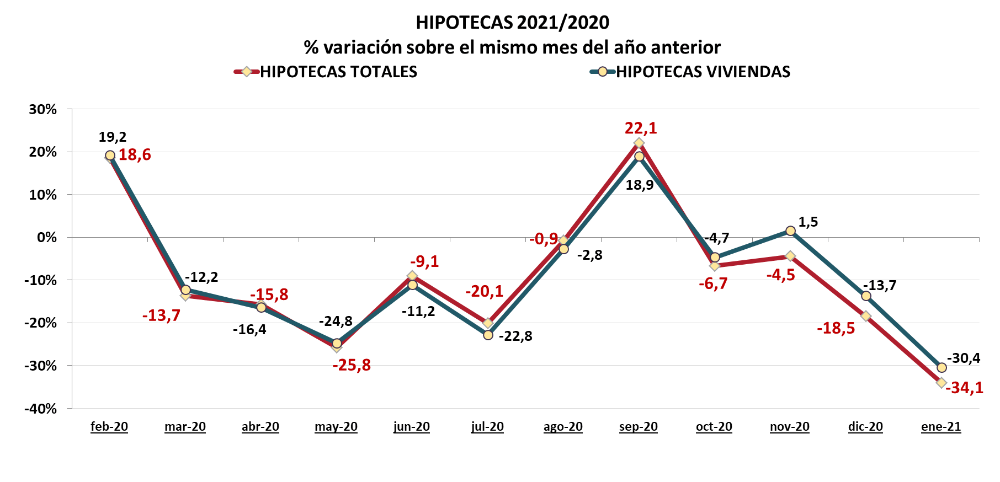

The Spanish Registrars Association notes that the mortgages constituted showed greater resistance to the crisis at the beginning of pandemic. In comparison with 2019 the biggest decline of 2020 was in May, when it reached of about – 25%.

In fact, it was the biggest fall of the mortgage market in the last 7 years. Of course, it was the impact of the pandemic. At the end of summer and in autumn the situation tended to stabilize, for a little while. In December a new drop begun. Registered mortgages, which were already showing significant drops in December, sharpened their decline in January.

In January 2021 there was the largest annual drop since the beginning of the crisis. It showed a decrease of 34.1% per year, which exacerbates the negative trend obtained in December (-18, 5%). Similarly, home mortgages in January 2021 also fell sharply, by 30.4%, showing a negative trend in comparison with December and also the largest decrease since the pandemic began.

According to Mortgage Statistics, published by the National Institute of Statistics (INE), in December the number of mortgages constituted on dwellings recorded in the land registries was 26,128, 14.8% less than in December 2019. The average amount of these mortgages is 144,358 euros, 7.9% higher than the same month in 2019.

The fantastic Spanish mortgage rates

Anyway, experts suppose that 2021 should bring a revival to the mortgage market. They assume that more loans will be issued this year. Many of experts point out the fact that Euribor, which determines the interest rate of European banks, still remains negative. Euribor is currently is sitting at almost -0,5%. And this make variable mortgage rates very low and very attractive.

Another reason which allow experts to call current situation “the best time for buying” is around nice changes that the bank of Spain made in 2019. One of them is a protective measure for those clients who don’t earn income in euros. So called the currency clause in mortgage documents. It implies that if that exchange rate falls more than 20 % over the entire sort of term of mortgage the clients can request to have their mortgage converted to their currency. Such measure protects a borrower from volatility in currency exchange rates.

When this was announced and rolled out in 2019 some banks initially stopped lending to all clients that didn’t earn income in euros. But it’s a mistake to suppose, that today all Spanish banks are not offering the mortgage product for the clients outside of EU. On the contrary, there is a plenty of banks that still offer mortgages to this kind of clients. However, it’s better to speak about it with a mortgage broker and to find out, who are the lenders that accept all currencies.

The other nice change that the bank of Spain made in 2019 is around who’s paying for what. The banks are now responsible for paying most of the fees involved in the purchase transaction including those what are called the AJD tax or it’s on the registering of the mortgage deeds. Thus clients can save themselves probably about 1,5%. And it proves the idea that it’s a great time for people to be considering to buy in Spain.

More opportunities for buyers property in Spain in 2021 or more restrictions?

Experts suppose that the mortgage will continue to cheap over the next year. And this will generate great opportunities for the buyer. At the same time market participants concern not the price, but the conditions and criteria that banks will set for borrowers.

Robin Christiani, mortgage advisor, points out that the banks are more strict, in general. And they look into the details of the profile of the buyer. However, if the client has a steady income and sufficient own funds there is a big chance of approval.

– I agree, the conditions depend a lot on the development of the pandemic and the Euribor rate. It all depends on how the virus will develop. When this is under control, people can travel and business can go back to work, we will see an automatic increase. Speaking about the scenario for the mortgage market in Spain in 2021 I see a lot of opportunities for non-resident buyers. The mortgage rates are low, which will make it cheap to take out a loan. Apart from this, house prices are stabilizing/lowering and there are a lot of urgent sales because of covid. Cash is King. The demand is still high. And I expect that when the virus is under control we will see a huge increase in volume and demand for mortgages and property sales.

In general, it will be more difficult to get a loan. Since everyone is affected by the virus and banks look with caution into sectors which have been affected the hardest. This means some clients have a harder time to take out a loan, but having said that, if the client has the proper funds and a stable income flow, there is a big chance to get a mortgage, – comments the expert.

He also mentioned that there will be more banks restrictions. It will take longer to get a loan approved and the banks will look into every operation with more detail.